Let’s face it, when it comes to strategic planning, data is the backbone of most businesses’ decision-making and, simply put, is essential. Without accurate, clean, and timely data, businesses are more likely to miss out on prime opportunities.

In the investment management industry, data is critical to make decisions. The industry’s ongoing structural shifts and changing regulatory requirements have made it difficult for firms to make sense of their data.

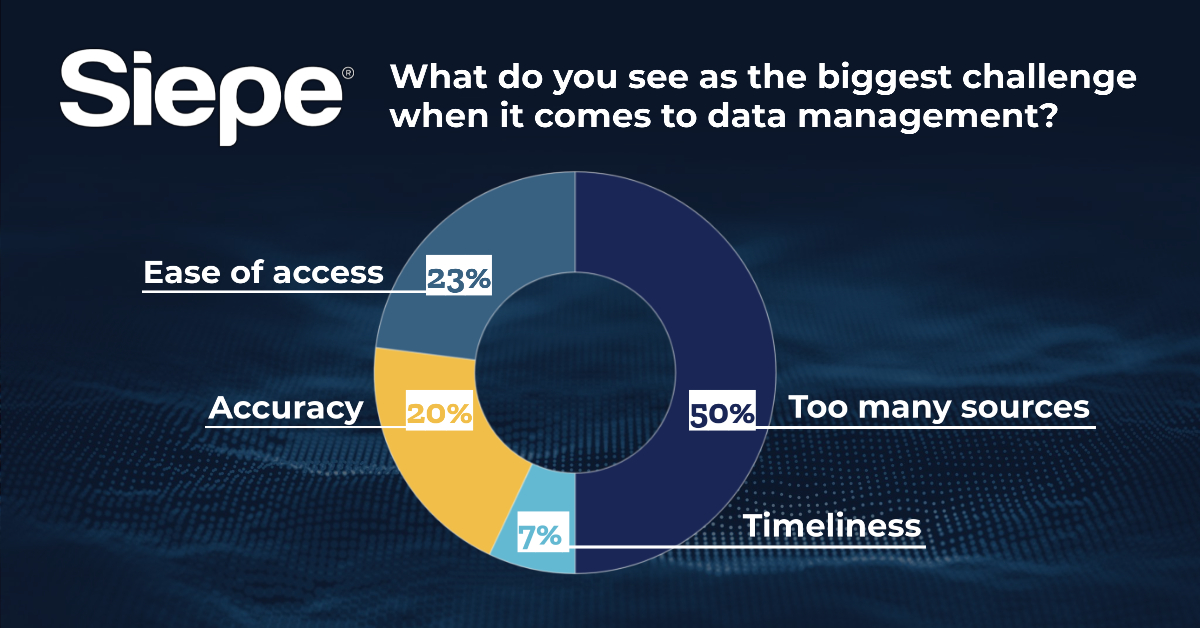

Siepe recently conducted a survey to identify key data challenges for asset managers. While results were mixed, these common challenges are further evidence of the fact that data management continues to be an important topic in an increasingly competitive investment landscape.

Here are four data management challenges and ways to mitigate them.

1 – Too many sources

Half of the voters thought having too many sources was the main issue with effectively managing data. This is not surprising as making sense of an abundance of data is critical for financial firms to derive context from the information and as a result, drive value. However, it can be incredibly difficult to source the truth when firms are met with too many data sets that can lead to inconsistencies or conflicting information.

Take ESG investing for example, which is a major trend in the investment management industry. There’s a plethora of data to support ESG investment principles, but how do firms source the data points to help them evaluate potential investments? How do you know which one to choose from? What are the costs involved? How relevant are they? Is it what investors want? These are only a few of the questions that firms may have when it comes to making an investment decision, but too many sources can steer away from the overall objective.

Thus, operating with a technology provider with a fully connected front-to-back office that can aggregate data, automate processes, and provide a single source of truth is critical for providing data with context and, as a result, mitigates the issues surrounding too many sources.

2 – Timeliness

While timeliness had the least votes, this is one of the most important aspects of managing data effectively. Availability of data is necessary for making critical business decisions. Over the past year, we’ve seen the importance of having access to data, especially in making time-sensitive decisions in light of the shifting work environment.

For firms that need to cut daily Net Asset Value (NAV) or even get close to real-time, the ability to pull timely market data or pricing data is important. Daily checks and balance functions such as reconciliation and margin calls all require timely data.

In the virtual environment, it is crucial to have automated processes in place to push timely and clean data to applications and consumers. As remote employees do not have the ease of talking to someone face-to-face to make decisions, it is more important than ever for firms to have a platform that enables timely delivery of data.

Without timely data, there will be undoubtedly delays in making investment decisions.

3 – Accuracy

Data accuracy was another popular choice that was identified by participants as a challenge. If data does not match the real event it is meant to capture, the value is lost. Ensuring data is error-free requires proper implementation, configuration, and exception management. Financial firms need a process in place so that they are not just information takers but have quality control to ensure the data is accurate.

Firms cannot effectively manage their portfolios without complete and accurate data. Essentially you want actionable data – data that makes you want to trade on.

4 – Ease of Access

Ease of access was also a major challenge for poll participants. Data is only useful if those who are making decisions are able to easily access that information. If you’re a consumer of data and you’re not a technical person, then you likely need to rely on a technical resource to help you cleanse and make sense of that data.

This can be resolved by working with a data provider that offers a single pane of glass portal and visibility into market data and portfolio analytics. A robust, comprehensive dashboard is one way to ensure access is not limited or compromised.

Managing data effectively may be complicated, but with the right protocols and systems implemented, these challenges can be eliminated. Working with an outsourced data provider that provides automation and transparency is one way to ease the pressure and make better use of financial data.